Since the COVID-19 pandemic arrived, more companies have been forced to rethink the way they budget and spend money. For instance, 49% of businesses reviewed supplier terms and 46% reviewed customer payment terms in 2020 alone.

The difficulties the pandemic brought made us all realize that we can and should take full control of our budgeting and spending. Poor spend management can 100% ruin a business, especially during the challenging times we saw last year.

Organizations now have a greater desire to improve spend management, and they’re moving quickly to update their systems and processes. One major development is the use of spend data analytics to optimize spend.

Year after year, businesses are using more spend data to drive actionable insights. Advanced data analytics have enabled finance and accounts payable teams to focus on higher-value activities, instead of manual processes that they can automate.

Better data analytics can help businesses worldwide get on a more secure track to financial sustainability. Let’s take a look at the top four spend data analytics trends to watch out for in 2022 and beyond.

More adoption of scalable and automated data analytics tools

We’ve seen many enterprise companies make the leap to cloud-based spend management software, with 46% of businesses seeing positive ROI within the first year of use. But businesses need even more from their expense tools to gain a competitive edge. Specifically, automated data analytics must become a core business function.

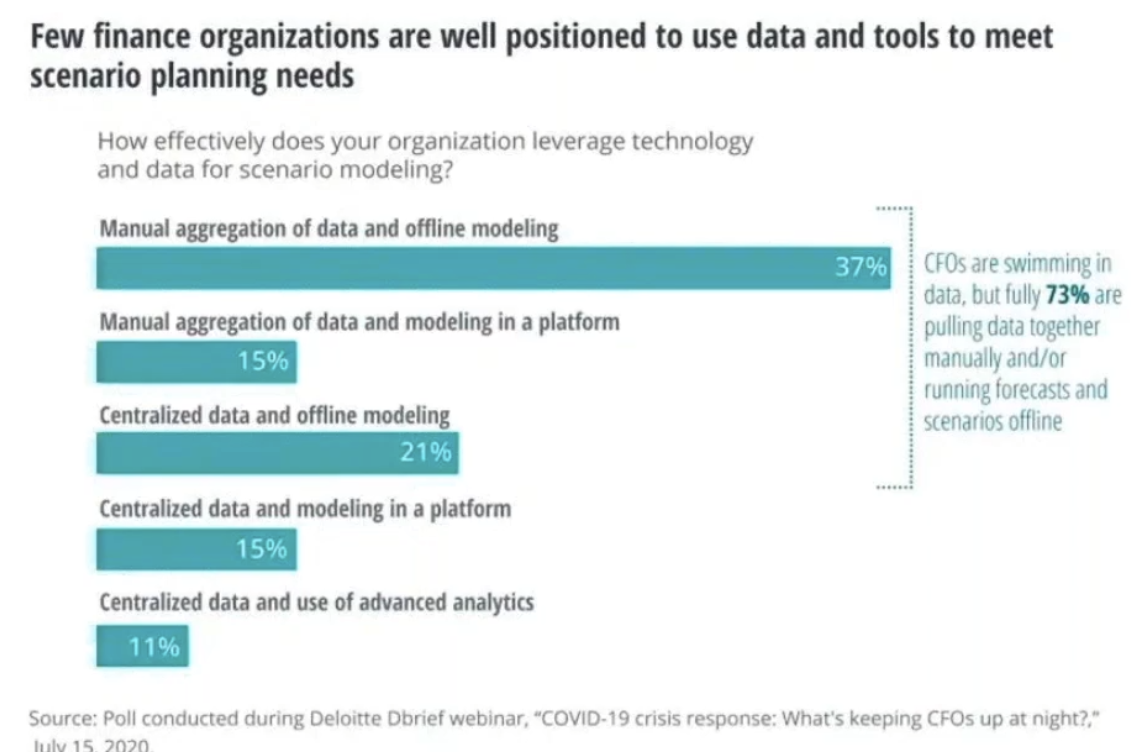

Recent research suggests that scalable and automated data analytics tools will increasingly improve workflow efficiencies, offer decision-makers deeper insights, and add untold value to organizations. Unfortunately, few organizations are ready to adopt modern data modeling and predictive data analytics platforms:

- Nearly three-quarters (73%) of CFOs still manually aggregate spend data and/or run forecasts and scenarios offline (i.e., unsynced, not centralized for all users)

- Over one-third (37%) of surveyed CFOs are still relying on both manually data aggregation and offline data modeling.

- Only a quarter (26%) of organizations are using both centralized data and modeling and/or advanced analytics.

This is why we predict more adoption of scalable, automated data analytics tools. In fact, best-in-class finance teams utilize spend data analytics for cash flow analysis, forecasting and budgeting, invoice exception handling, and fraud/compliance management.

From better budgeting to increased spend accountability and improved compliance, automated, centralized data aggregation and data analytics have a lot of potential to make spend management not only more efficient, but also to drive performance and growth in any organization.

Predictive data and analytics must become core finance business functions. According to a recent Gartner report, “Smarter, more responsible, scalable AI will enable better learning algorithms, interpretable systems and shorter time to value.” However, in order to achieve this level of automation, companies must “figure out how to scale the technologies.”

For spend management teams, having the right software is so crucial to using data correctly. As you continually scale and refine your analytics, DevOps teams will need software that not only has analytics and automation capabilities, but that is also accessible and usable for everyone in the organization—not just those with data skills and know-how.

More integrated dashboards for better visibility & compliance

Cloud platforms that display spend data on accessible, user-friendly, and easy-to-understand dashboards give an instant return on investment for two main reasons:

- Team members can understand and use data more efficiently. Neuroscientists from MIT discovered that the human brain can process images the eye sees for as little as 13 milliseconds. Data visualizations are much more efficient than stuff spreadsheets.

- Dashboards integrate all spend data in one place. With organization-wide visibility, the potential for human error and expense fraud decreases. Up to 47% of companies dealt with fraud in 2020 (PwC), and the lack of visibility into spending is a big reason why it happens so often.

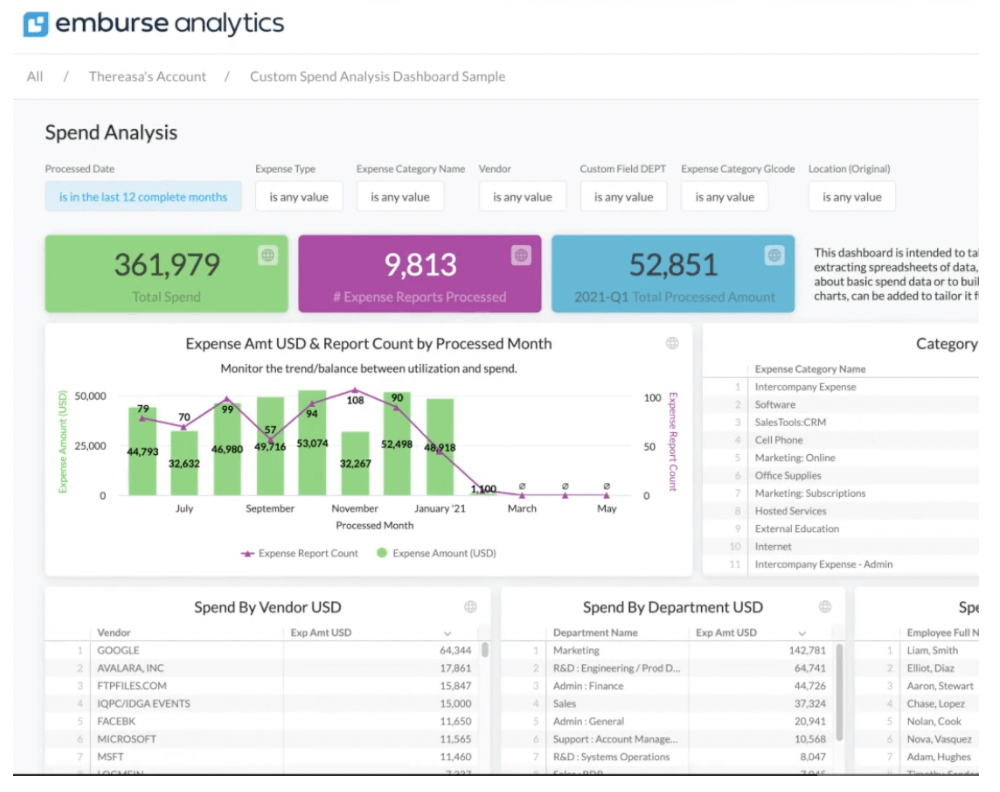

An spend data analytics dashboard brings all your expenses onto one screen, providing great visibility into spending across vendors, employees, departments, and more (source)

When you don’t have an accurate picture of spend, everything from cash flow management to reporting and compliance is at risk. Dashboards help ensure transparency and accountability. Expense data analytics dashboards have great potential to improve visibility into spending and ensure compliance with policies.

Moreover, expense dashboards ensure teams can help you stop wasting time and resources on mundane tasks. Instead, you can focus on finding actionable insights in the data.

For example, 86% of Emburse Certify clients said that moving to an online solution with powerful visualizations helped boost productivity (source). They had more time to focus on high-value analyses of their expenses, budgets, and vendor/customer relationships.

As companies continue to work remotely, a unified platform with data visualizations will play a larger role for finance departments, accounts payable teams, and travel managers.

Data automation & intelligence will drive profitability & growth

Too often, business leaders think of data analytics as too complex. They then don’t put in plans to capitalize on all the opportunities data offers.

Specifically, spend management software with data analytics capabilities can help optimize spending. Over time, you’ll have reams of historical and real-time data to analyze. Through spending pattern analysis, finance teams can arrive at more prudent expense policies, make better budgeting decisions, and save more money by negotiating discounts.

Considering the capabilities, spend data analytics should have an elevated position not only in AP, finance, and accounting departments, but also within the organization as a whole. Research shows the value of prioritizing spend data analytics as a company.

- 43% of CFOs believe streamlining their company’s budgeting process with data and automation is a key to long-term success (McKinsey report).

- When Chief Data Officers get involved in setting company strategies and goals, they boost production of business value by 2.6x on average (Gartner report).

- 97% of best-in-class spend management and AP teams view data and intelligence as critical to organizational success.

In addition to adopting better reporting practices, companies must emphasize learning and development. You can’t get the most out of your data if you don’t have a team with the necessary skills. C-suites and other key stakeholders should invest in continuous analytics education, as well as cultivate a culture that values data and intelligence as a core part of the operation.

The good news is most companies are making these investments. According to Alteryx, more than 120,000 are upskilling on their platform—a testament to the increasing importance leaders are placing on data analytics skills.

Predictive analytics will deliver more operational efficiencies

Cash flow will always be king. If you don’t strategically manage your expenses, you will hurt your cash flow.

The best way to improve cash flows? Increase revenue and reduce expenses. Better spend management can help, especially if you’re able to extract actionable insights from your spend data.

As we’ve discussed, spend data analytics can help your business increase transparency, improve accountability, and reduce leakage. Considering the benefits, it’s clear that finance leaders will increasingly rely on spend management software to boost profitability and growth.

Finance teams, accounts payable departments, and travel & expense managers have all begun to realize just how powerful advanced analytics and data analysis can be:

- Negotiate better terms with vendors

- Identify and reduce risk and fraud vectors

- Streamline workflows and reduce cycle times

- Leverage accurate, real-time data and analytics

- Understand where policy compliance needs to be enforced

- Forecast cash flows, conduct scenario analysis, and always stay within budget

Going forward, finance leaders and accounts payable teams should look for spend management software that can deliver tailored solutions and customized insights. The best business decisions will always be data-driven.

The future of data-driven spend

In 2022 and beyond, look for continued adoption of cloud-based spend management software. Integrated expense dashboards that are equally accessible on desktops or mobile devices will also become more common. Having a unified view of spending anywhere, anytime is the only way to ensure 24/7 compliance and transparency.

Moreover, enterprises and corporations will continue to lean on data expense analytics to optimize spending patterns. Finance leaders will continue to depend on data expense analytics to inform strategic budgeting and spending decisions. CFOs will rely on clean, up-to-date data more in order to leverage actionable insights that can boost organizational profitability.

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.