A number of factors have contributed to a positive outlook for small to medium-sized enterprise (SME) growth, both in the US and internationally. A recovering economy, improved credit availability, increasing internet speeds, the affordability of cloud technology and the resulting accessibility of financial process automation have all played a part in creating an exciting new chapter for growing businesses. SMEs are finding new doors open to them in terms of technological advancements that were once considered the exclusive domain of big corporate players.

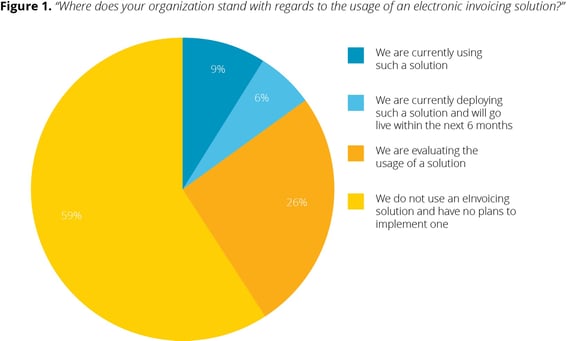

The rapid proliferation of cloud service providers and the associated cost savings of cloud communications technologies allows SMEs to harness the power of financial automation technology to drive up productivity, lower costs and increase cash flow. But according to our recent report on Automating P2P for SMEs, a majority of the sector does not recognize the accessibility or advantage of these solutions; see Figure 1.

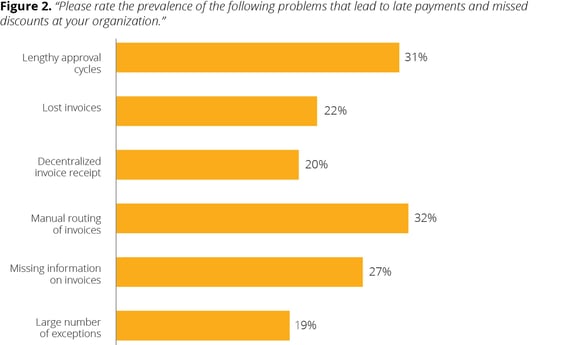

Before they can capitalize on working capital management tools and turn AP into a revenue generator, the majority of SMEs must reign in the tedious front end processes that wreak so much havoc. SME survey respondents reported that one of their greatest AP pains—and causes for lost revenue—is the manual routing of invoices. Their other leading pains are also closely related to manual processing; see Figure 2.

CHANGING PERCEPTIONS, ONE SME AT A TIME

It’s clear that SMEs continue to suffer from a low level of P2P automation that results in troublesome processing pains that not only lead to clunky, expensive invoice routing methods, but lost revenue. What’s holding them back from implementation of one of a multitude of products on the market?

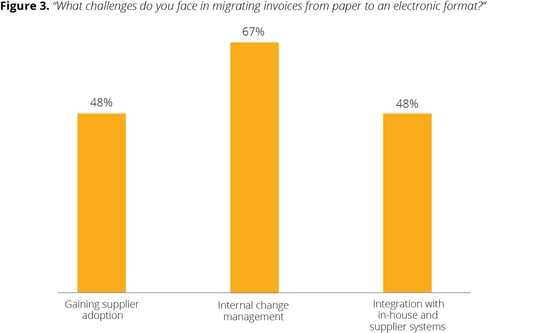

Perhaps not surprisingly, the number one obstacle to automation cited by our survey respondents was ‘internal change management;’ see Figure 3. SMEs have long been excluded from the finance process automation market, and a perceived sense that these solutions are exorbitant and irrelevant to them no doubt continues. The prevailing sentiment is that because there are so many components involved in the P2P process, automating all or part of it requires a complex, highly customized software platform installation, along with vast IT resources to support it. This has been a common misconception among the SMEs we’ve surveyed and benchmarked.

However, PayStream’s analysts have found that quite the opposite is true in many cases. Many of today’s solutions are vendor hosted (SaaS) and operate in a cloud environment, which means they are modular and can be leveraged with other software and existing ERPs. This allows for greater scalability and control in diverse business environments. And since the business models of most SMEs are naturally positioned to work well with even the smallest amount of process automation, they can often realize a shorter time to ROI.

For more insight into current trends as well as profiles of several solution providers, download the full report, Automating P2P for SMEs.

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.