Business Travel is Down - But Not Out?

Last year, COVID-19 travel restrictions and the rise of remote work drastically changed travel as we know it. The pandemic shook up the longtime status quo in a big way. But that doesn’t mean business travel is going away. In fact, numerous decision-maker surveys and polls have revealed that executives expect T&E to stay on their balance sheets.

As the world gets used to a new, pandemic-informed status quo, decision-makers need to decide how to best budget for and incorporate travel into their strategies. Many executives are planning to resume domestic business trips before the end of the year. Some believe the future of travel will involve fewer, more strategic trips that require more upfront planning and cost more per flyer.

However, as worldwide vaccination rollouts continue, one thing’s for sure: employers, employees, and industry experts believe that business travel will eventually make a comeback. Here’s what they’re expecting in 2021 and beyond:

How COVID-19 impacted global travel

The Global Business Travel Association (GBTA) just published its annual BTI™ Outlook, a detailed analysis of 2020 business travel spending and growth, with projections for 2021 and beyond. The study covered 48 industries across 75 countries.

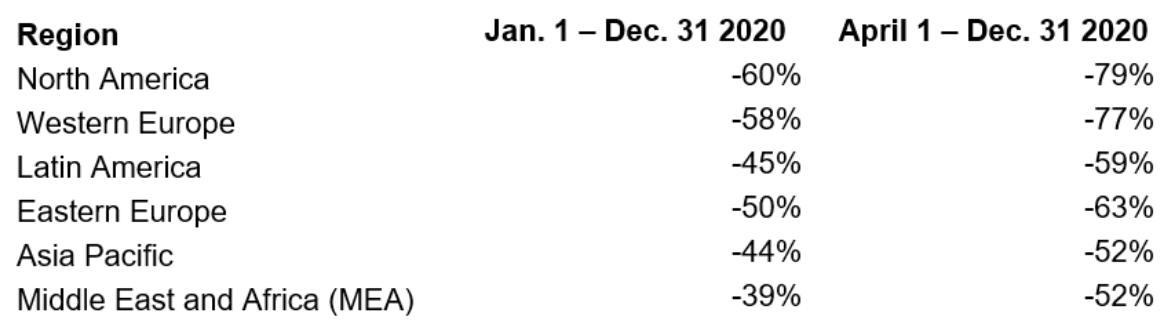

The study’s findings reveal that COVID-19 cratered global business travel in Q2 2020, leading to a 68% YoY decline from April 1 to the end of the year. Q1 2020, which was relatively normal, balanced the numbers out a bit, leading to a 52% decrease in global spending on business travel for all of 2020 ($694 billion vs. $1.4 trillion in 2019).

The impact of COVID-19 restrictions on business travel spending varied by region.

With numbers like these, even the most optimistic business traveler may feel uncertain about the future of travel. “The pandemic has been devastating for business travel and it’s clear our industry will take some time to recover given the challenges we’re facing on multiple fronts,” said Dave Hilfman, interim executive director of GBTA. “Economic recovery is already underway, although very uneven across countries and sectors.

How employers are preparing for the future of travel

1. Businesses are preparing for more T&E spending

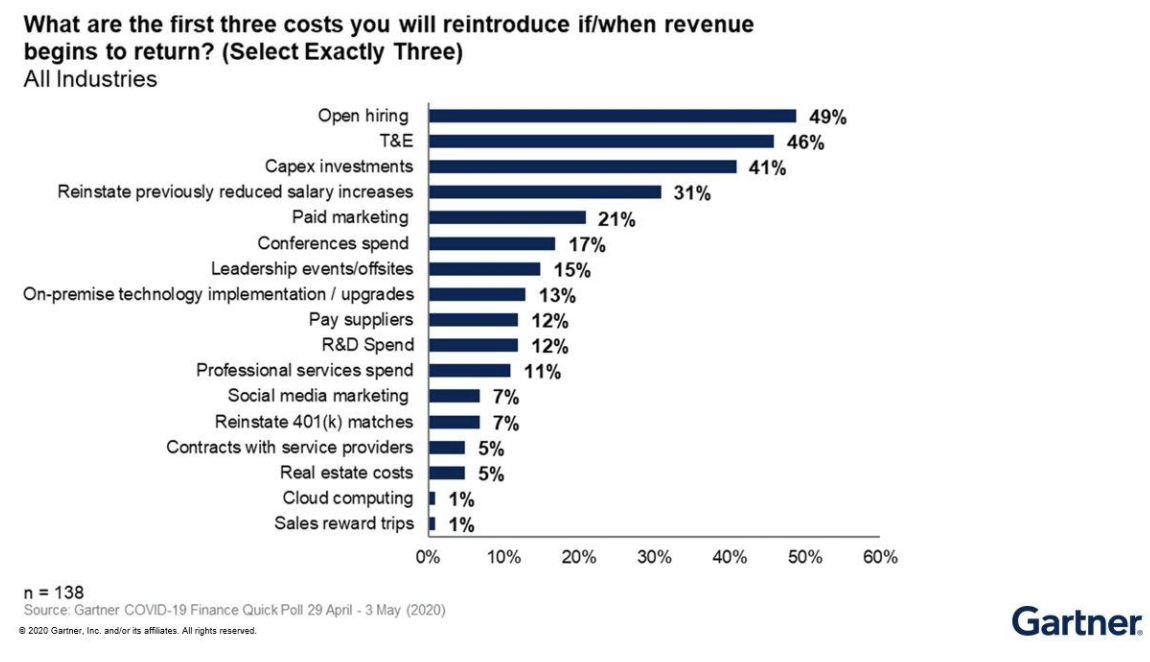

Gartner’s April 2020 survey of 145 CFOs and senior finance leaders reveals that shortly after the start of the pandemic, many organizations anticipated that travel and expense (T&E) would be second only to open hiring in terms of increased spending (46% of respondents vs. 49%).

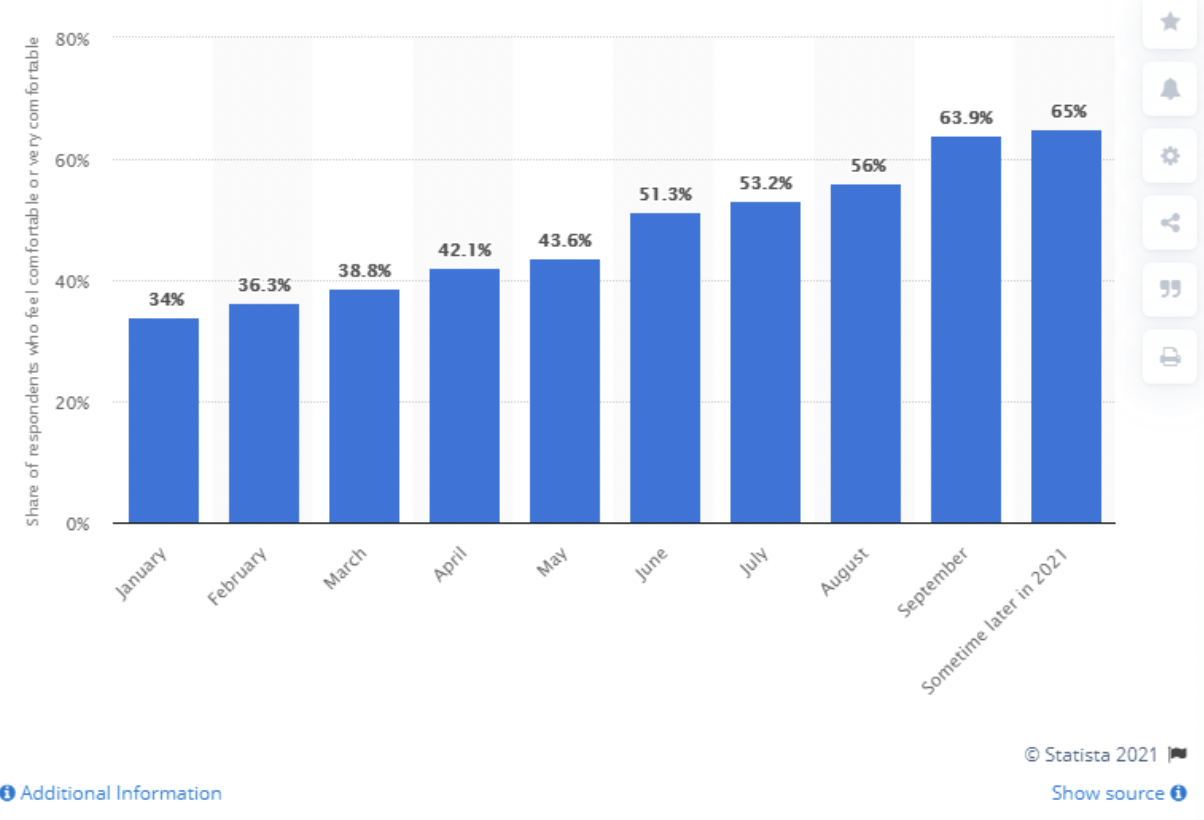

The recent December 2020 survey by Statista shows that Gartner’s prediction held up throughout the year. Up to 64% of respondents would visit conventions by September 2021, assuming conditions continue improving.

“Thinking about the current situation of the COVID-19 pandemic, in which month would you feel comfortable to attend conventions or conferences in 2021?”

2. Business travel should slowly go back to normal

GBTA’s BTI Outlook indicates that there’s quite a bit of consensus among industries worldwide that business travel will pick up in 2021, especially in the second half of the year as travelers warm up to summer. Organizations around the globe expect:

- A 21% increase in business travel spending is expected to come by the end of 2021 as vaccinations increase globally and consumer confidence returns.

- A significant acceleration in business travel heading into 2022, including a substantial increase in group meetings and international business travel.

- Business travel spending growth that exceeds the historical average of 4.6%. By the end of 2024, business travel spending is projected to reach $1.4 trillion, almost equaling the pre-pandemic revenue peak of $1.43 trillion in 2019.

- A full recovery to pre-pandemic levels by 2025. Of course, that depends on a lot of things going right and a lot of positive news surrounding vaccinations, COVID-19 rates, and international policies.

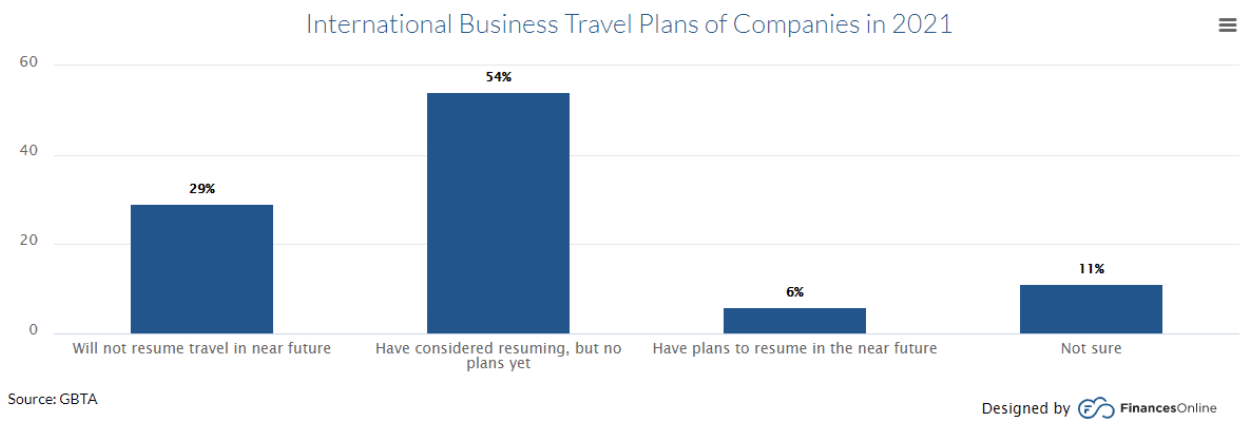

3. 54% of companies have considered resuming travel

GBTA’s findings are in line with Reuter’s. Most businesses are considering resuming corporate travel for 2021, although they don’t have any short-term plans in mind. More than half of surveyed companies fell into this category (54%), a third had no plans to resume travel shortly (29%), and a tenth were undecided (11%).

Only a few companies planned on resuming business travel soon (6%).

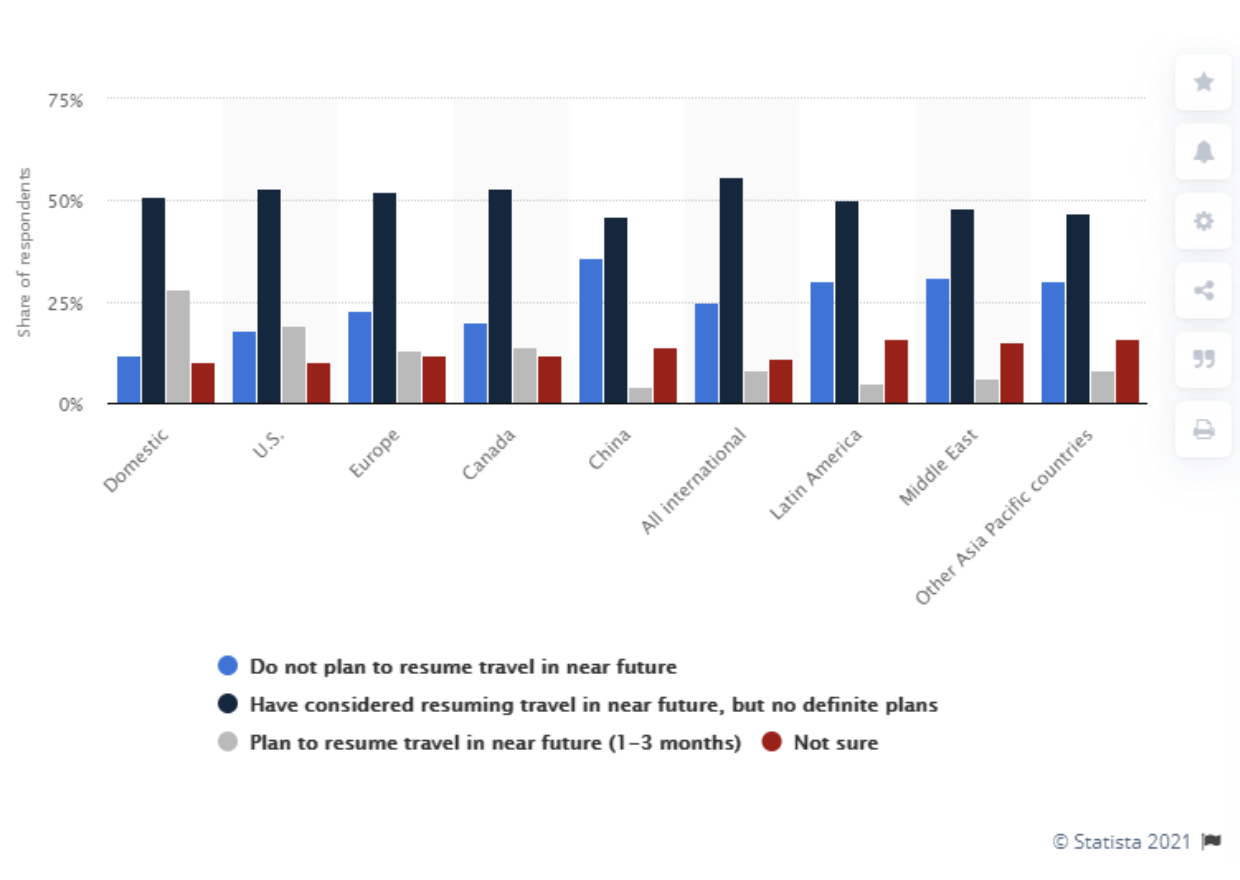

According to a similar March 2021 Statista survey, 28 percent of respondents said they had considered resuming domestic business travel in the near future (1–3 months). But only 8% of respondents thought that their companies would resume international business travel by then. That being said, some regions are expecting more business travel than others:

“Is your company planning to resume travel to the following destinations?”

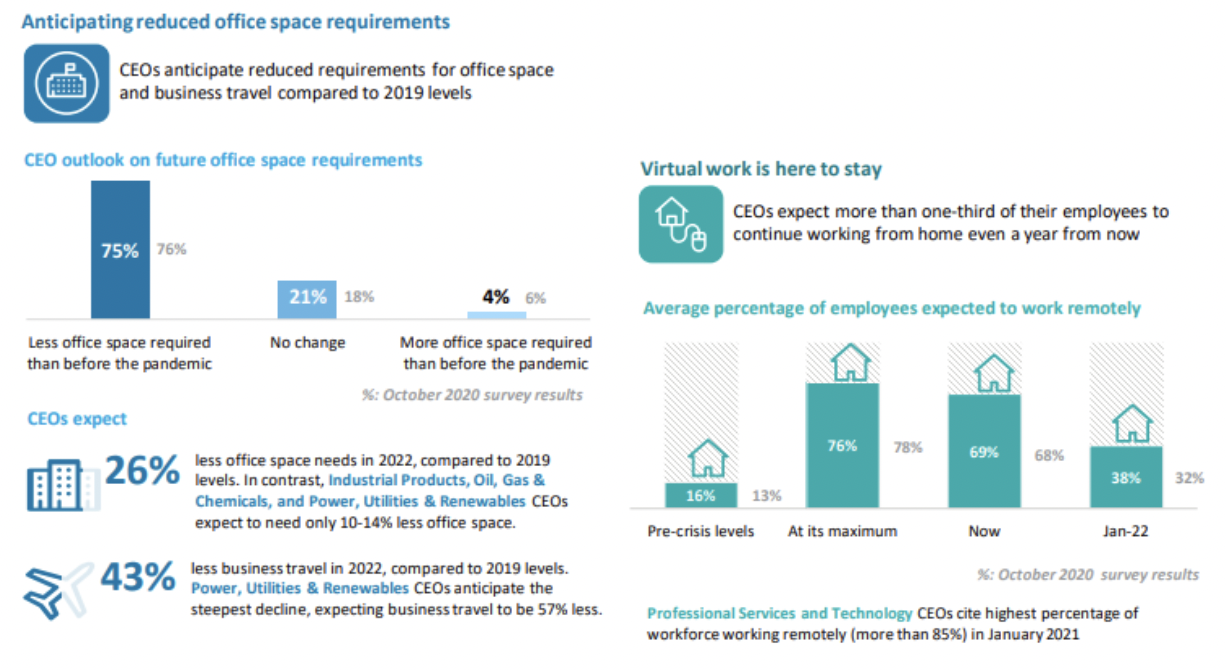

4. CEOs expect less office space and more remote workers

Why does this matter for the future of travel? Because a reduction in one expense category (i.e., office rents) could lead to an increase in another category (i.e., T&E). For example, some executives anticipate that their companies could invest the money they save in office expenses into highly strategic business trips instead.

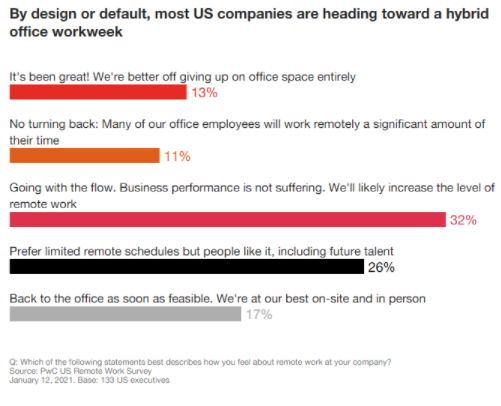

Deloitte and PwC have some bad news for Jamie Dimon, the outspoken CEO of JPMorgan Chase, who believes that getting employees back into the office is non-negotiable (at least for major investment banks). As it turns out, remote work is here to stay because, somewhat unsurprisingly, both employers and employees seem to really like it.

A Fortune and Deloitte co-study that polled 100 CEOs in January 2021 found that 75% of CEOs expect less office space going forward. There may be 26% less office space required by 2022. Meanwhile, 43% of CEOs believe there will be less business travel in 2022 compared to 2019. Notably, 38% of employees were still working remotely.

According to PwC’s US Remote Work Survey of 133 executives and 1,200 office workers conducted in November and December last year, only 17% of surveyed employers are itching to get back into the office as soon as possible. The other 83% of employers are getting very comfortable with remote work or see it as an inevitable trend.

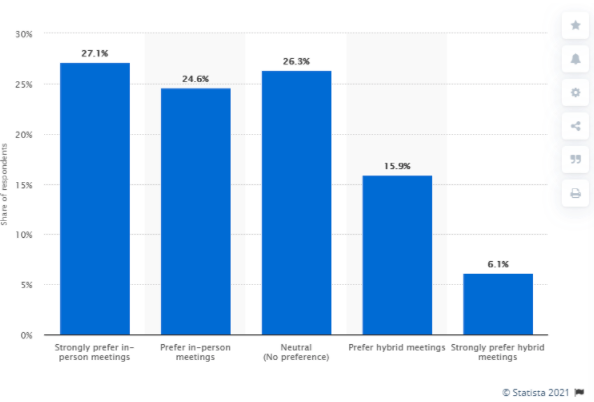

5. People still prefer in-person or hybrid meetings

Interestingly, the rise in remote work patterns and fewer office expenses doesn’t mean that employers or employees don’t like to meet each other in person. In fact, according to a December 2020 Statista survey, 51.7% of US business travelers still prefer in-person meetings over hybrid conferences or virtual events. Only 22% of travelers preferred hybrid meetings.

“If you could choose between in-person and hybrid meetings, which one would you prefer?”

While the pandemic may have forced people to work from home and meet virtually, it doesn’t mean that everyone’s happy about it. After all, humans are inherently social creatures, and being stuck at home all day long isn’t everyone’s cup of tea. “It’s become very trendy to talk about business travel not needing to come back,” Evan Konwiser, EVP of product and strategy for American Express Global Business Travel, told Bloomberg. “There’s some truth there that we should acknowledge and adapt to. “But business travel exists for really important reasons—it helps businesses conduct business successfully,” he continued. “People want a break from being home. Getting to travel a week a month, that would rebalance everything enormously.”

Prepare for the business travel rebound

While the short-term future remains a bit uncertain for business travel, long-term projections remain optimistic. That’s excellent news for the business travel industry and business as a whole. But it doesn’t mean we’re getting back to 2019 anytime soon, either.

“One has to be realistic,” Gary Kelly, CEO of Southwest Airlines, told Bloomberg TV. “In a typical recession, business travel is cut very sharply, and it’s five years before it recovers to pre-recession levels. Is this a normal recession? No. But you have the added complication...of the virtual and remote work environments that have been created over the last year.”

How will the slow recovery of business travel affect spending? That’s the question on everyone’s mind as we gear up for summer. Check out part Part 2 of this series, where we’ll go over how travel trends may impact the future of travel and expense management, as well as the growing importance of duty of care.

Subscribe to stay on top of what’s coming next.

Learn how Emburse Chrome River will make business travel easy and efficient and help prepare you for the post-pandemic world, today!

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.