Have you seen the Rocket Mortgage Super Bowl commercial with Tracy Morgan? In the commercial, Tracy Morgan shows us why “certain” is better than “pretty sure” through a series of instructive scenarios:

- “I’m pretty sure these aren’t poisonous” (before eating a poisonous mushroom).

- “I’m pretty sure these are parachutes” (when preparing to jump out of a plane).

- “I’m pretty sure you can take Bautista” (before getting punched in the face).

By the end of the commercial, the lesson is clear: Be certain, especially when making a big purchase like a house. Or else a disaster may be just around the corner.

When shopping for a spend management solution, the same lesson applies. Businesses must be more than “pretty sure” the software works well. They must be 100% certain. These solutions cost a lot of money. The wrong choice could lead to inefficiencies, wasted resources, and even undetected fraud.

The problem is that many expense management systems and homebrew solutions rely on outdated features and processes. They’re not built for the modern, remote, and mobile-first workplaces of the 21st century.

For example, according to an Emburse survey, 68% of companies still use a manual method to enforce travel and expense policies even if they have a cloud-based expense management solution.

If you’re looking for reliable, accurate, and trustworthy spend management software, you have to be certain. Exercise caution and do your due diligence by thoroughly researching, evaluating, and comparing products. Choose an up-to-date solution that benefits you today and prepares you for tomorrow.

So, you’re pretty sure your software doesn’t have murder hornets

You’ve probably heard the stat that a bad hire costs you up to 30% of that employee’s annual earnings. But making the wrong technology investment can cost you far more:

- Large corporations that don’t have up-to-date tech stacks spend 51% more on repairs and plugging data breaches compared to corporations that update their tech stacks regularly. This adds up to $389,000 wasted annually across the organization (Kaspersky).

- 25% of employees contemplate leaving their job because of bad software. Overall, 1-in-8 employees leave because of the poor work experience bad software causes (Vendor Neutral).

- 95% of workers say better software would make them more productive, while 65% of workers say bad software makes them less efficient at their jobs (Vendor Neutral).

When choosing expense management software, being pretty sure the software is good won’t cut it. As the Rocket Mortgage commercial shows, being pretty sure could still lead to killer hornets swarming you.

Think about it this way. If you’re not 100% certain and confident about the expense management software you’re eyeing, maybe you should reconsider. Productivity, employee happiness, and profits are at stake.

Naturally, this also applies for your current technology stack. If you’re not 100% confident in your existing expense management toolset, then maybe it’s high time to get that upgrade.

How you can be certain your software can make the jump

If you want expense management software that keeps you competitive in today’s fast-paced mobile world, you need to avoid making “pretty sure” mistakes and oversights. Ask yourself the following questions about your current expense management solution:

- Does it involve too much manual input? Almost 90% of spreadsheets end up having errors, and you can lose a lot of money because of those simple typos.

- Is it mobile-first? Employees hate submitting expense reports, especially if they have to do tedious things like save and organize receipts. But let them submit expenses in real-time with mobile-first platforms, and they’ll sing a different tune.

- Is it transparent and unified? According to the Human Resource Executive, nearly 60% of workers say their work tools are disjointed, glitchy, and hard to use. This can lead to productivity issues and mistakes that impact cash flow.

- Does it follow cybersecurity best practices? Outdated legacy systems leave your organization vulnerable to fraud and cybercrime. In fact, the average data breach costs organizations $3.86 million (IBM research).

If you can’t answer “Yes” to all of these questions, then you can’t really be certain that you’re using the best expense management solution. You might be “pretty sure,” but you’re not totally confident.

Perhaps it’s time to adopt a holistic, unified expense management solution—one that gives your organization transparency, accountability, and efficiency. The right solution (that makes you feel 100% certain) should help you streamline and automate finance, expense management, and AP tasks such as expense submission and processing, reimbursement approvals, and policy compliance reviews.

By automating everything that can and should be automated, your teams will finally have enough time to focus on what matters most: extracting actionable insights from spending data, improving and optimizing workflows, making better strategic and financial decisions, and driving value for the business.

Can you afford modern expense management software?

When shopping for a new expense management solution, price tags don’t tell the whole story. For example, you wouldn’t buy the cheapest house just because it’s the cheapest. Who knows what kind of repairs and upgrades you’d need to make!

In the same way, legacy software can cost you a ton to maintain and operate. Did you know that the US federal government wastes 80% of their IT budget operating and maintaining existing legacy software? It’s a prime example of tech debt, which only gets worse over time for outdated systems.

For instance, SAP Concur is an expense management solution many enterprise-level companies still rely on today. Technically a cloud-based SaaS solution, SAP Concur has been around since the 1990s.

While it was once a cutting-edge solution, Concur has been showing its age for some time now. It doesn’t have a fully optimized user experience and requires constant, manual interventions for creating and submitting claims. You also need help from Concur support every time you want to integrate the platform with other business systems.

Simply put, Concur:

- Isn’t mobile-first: Some features are only available in the web browser / desktop app, and the mobile experience leaves a lot to be desired.

- Isn’t very flexible: If you want to make changes, you have no choice but to implement your changes live—without knowing whether they’ll even work ahead of time.

- Poor auditing and process control: Automation capabilities and fraud detection need improvement.

Speaking of price points, while SAP Concur is a well-known brand name, paying top dollar for an outdated, legacy product may not give you the best bang for your buck.

For a high-value, infrequent purchase like enterprise software, you have to do side-by-side comparisons to determine which software brings the most value to your business.

With Emburse, you can be certain—not pretty sure

Unlike Concur, which was built in the ‘90s for ‘90s organizations, Emburse Chrome River is a modern, cloud-based expense management platform designed for complex enterprises with evolving needs.

Chrome River’s suite of solutions automate expense management, improve efficiency, and grow with your company. Even better, you can tailor Chrome River to meet your unique needs or to suite specific work styles and workflows.

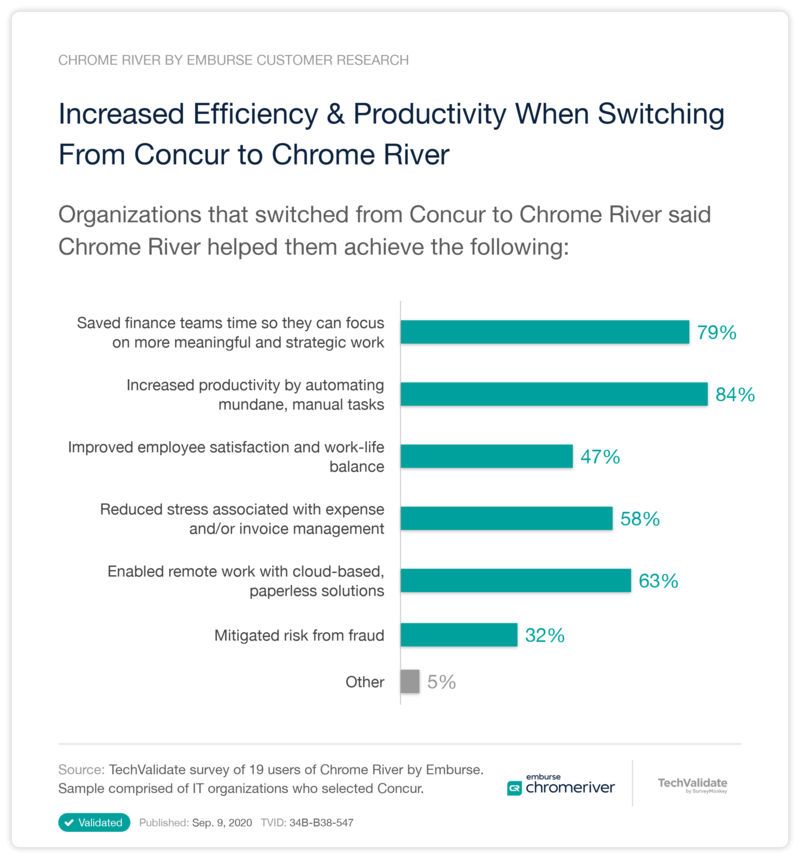

Over 160,000 organizations rely on Emburse solutions to eliminate manual processes, ensure compliance, reduce risks, and analyze real-time spend data to uncover actionable insights. Organizations that made the switch from Concur said Chrome River helped them achieve the following:

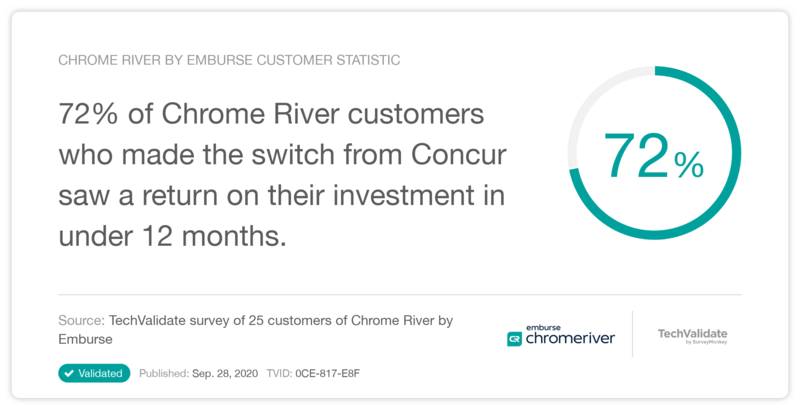

With Emburse, clients not only get affordability, but they also get the features they need to achieve greater savings, reduced fraud, higher productivity, and overall better return on investment. Maybe that’s why so many companies that made the switch report ROI within 12 months:

For instance, Allianz Partners North America came to Emburse seeking to optimize operational efficiencies and improve their expense management process. By utilizing our cloud-based expense management and AP automation software, Emburse Chrome River, Allianz achieved incredible results:

With Chrome River, you don’t have to be pretty sure, either. You can be 100% certain you’re making a wise purchase. Contact us today to learn more about how our expense management solutions can benefit your business.

Be 100% Certain of Your Spend - Get you demo today!

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.