Although the pandemic began over 1.5 years ago, it continues to impact every enterprise function. In fact, 80% of organizations report being negatively impacted by the pandemic, according to an Emburse survey. Procurement must deal with supply chain disruptions, while IT has to scramble to upgrade or invest in new technology that supports a remote workforce.

And everyone’s looking at Finance to make sure money isn’t being wasted. Given AP teams’ control and insight into company cash flows, finance leaders would be wise to rethink their AP function and look for opportunities for improvements.

For many companies, there may be lots of room for AP improvement. Like your dad writing and mailing checks to pay the bills, far too many AP teams have an old-school paper problem. Research from Ardent Partners has revealed that:

- 49% of invoices still need to be manually processed.

- 60% of AP departments rank invoice and payment approval efficiency as a top priority.

- Only 15% of AP teams have access to automated reporting and analytics.

Automated AP cycles lead to more efficient spending

Imagine how much time you’d save by paying on the go (with virtual cards) vs. writing checks.

Imagine how much time you’d save by paying on the go (with virtual cards) vs. writing checks.

Within any corporation, the cost of manual AP processes can be staggering when you add up the numbers. As an example, the average AP clerk can only process 5 invoices per hour. This creates an unsustainable, time-consuming bottleneck at larger companies.

If your AP team is processing invoices manually, you could be saving 25–40 hours per month by switching to an automated expense management solution. Not only does this get rid of processing delays, but it also frees up time for AP team members to focus on high-value, high-impact work (which you can’t put a price on).

Automated AP cycles also come with easily measurable ROI. For instance, automated invoice processing and reconciliation could save you up to $16 per invoice, according to industry research. That means that if your business processes 1,000 invoices per month, you could save $192,000 per year—just by automating a single AP function.

Best-in-class AP teams enjoy countless business advantages. They can achieve exception rates as low as 1%, see 3.2x-higher straight-through processing rates, and process invoices at an average cost of just $2.50—an 84% cost reduction.

Of course, AP optimization involves much more than just process automation and cost efficiencies. True AP success requires data intelligence.

Reliable AP intelligence drives better business outcomes

While AP teams have reams of data on hand (in the form of paper receipts, paper audit trails, and Excel spreadsheets), not all of that data is accurate or reliable. As a matter of fact, most Finance team members do not believe that their financial data is dependable.

In a recent global BlackLine survey of more than 1,100 C-level executives and Finance professionals, 55% of respondents admitted they weren’t confident in their data quality and didn’t think they could identify financial errors before reporting results.

Even worse, 69% of Finance teams confided that their CEOs and/or CFOs had made consequential business decisions using what may have been inaccurate financials.

Unsurprisingly, most CFOs agreed on a common cure-all: better data automation and analysis.

- 43% of CFOs believe streamlining the budgeting process with data and automation is a key to long-term success (McKinsey).

- When Chief Data Officers help set company strategies and goals, they boost business value by 2.6x, on average (Gartner).

- 97% of best-in-class expense and AP teams view data and intelligence as mission-critical to organizational success (Ardent Partners).

Of course, it’s not enough to know that your organization must automate data collection and curation so that your Finance team can more consistently analyze spend data for actionable insights. You also need the right tools for the job:

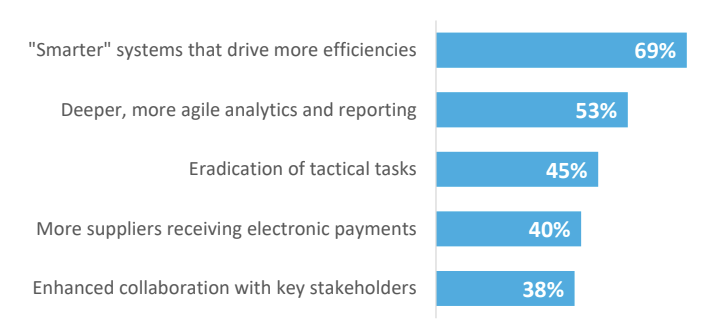

- 69% of AP leaders say they need smarter technology systems.

- 53% of AP leaders say they need deeper, more agile analytics and reporting.

- 40% of AP leaders say they need more suppliers to receive electronic payments.

When empowered with intelligent predictive data analytics, AP teams can optimize spend management and uncover insights that help:

- Reduce revenue leakage and wasted budget

- Negotiate better deals with vendors

- Enforce spending compliance

- Unlock new growth avenues

Ditch the checkbook! Here’s how to get more out of your AP team

For too long, the AP teams have gone overlooked, lacking the voice needed to drive substantial change for their organizations. COVID-19 changed that—cash flow and spend optimization have become increasingly important, consequently elevating the AP department’s influence.

Now, AP teams have the ability and resources needed to implement real change and leverage new technologies. But in order to do this, they must be communicative, collaborative, and agile. Only then can they be seen as part of the holistic business ecosystem, ensuring business continuity and resiliency while unlocking new growth and opportunities.

Let’s discuss how the AP team can achieve maximum efficiency and intelligence—and ultimately be a game-changer for the enterprise.

Enable AP automation with the right tools

Your finance department shouldn’t be moving at a snail’s pace.

Efficiency and intelligence depend on AP automation. Unfortunately, many organizations don’t have the necessary tools in place to automate their AP processes.

Keep in mind, 53% of organizations still don’t have dedicated expense management software. If you’re still doing things manually, it’s time to get the AP team together with finance leadership and decide on the right tools for the job. The ROI is palpable—Emburse research found that 46% of organizations that switch to a cloud spend management platform earn positive ROI in less than a year, thanks to greater savings and efficiency.

Align the AP team and CFO

60% of CFOs don’t have sufficient visibility into transactions within their organization, according to research from The Economic Intelligence Unit. This makes it difficult to analyze spend, identify waste, and unlock the potential of expense data analytics.

AP teams have a unique insight into expenses and day-to-day cash flow. The CFO should develop goals and objectives with the accounts payable staff that utilize these insights. With everyone on the same page, your organization will enjoy:

- Better control and insight over spend

- More insightful invoice payments

- More organized ordering

- Fully optimized spend

You’ll be rewarded with better cash flow management across the entire organization.

A recent Gartner survey found that organizations pay a hefty price for poor data quality: $12.8 million per year. In another Gartner survey of 126 enterprise-level respondents, decision-makers revealed their biggest data management challenge was improving data quality.

Improve AP team agility

COVID-19 has kept every organization on its toes, necessitating the adoption of short-term workarounds, new tools, and a culture that embraces change. If anything, it’s made one point obvious: to survive, your organization must be agile—and that includes your AP team.

The stats are revealing: truly agile firms are more than twice as likely to achieve top-quartile financial performance (than their less flexible counterparts) (Accenture).

Going forward, C-levels would be wise to invest in developing agile AP workforces. After all, talent remains a top differentiator, and having an AP team capable of responding to real-time business changes will benefit your organization tremendously.

Push the AP team to become forward-thinking and strategic

The good news is that most accounts payable and expense management departments are ready to take on more strategic roles. As an Ardent Partners study found, 48% of AP teams consider ‘improved AP reporting and data analytics’ a top priority. They want to dig into the data, extract insights, and deliver value to their organizations.

To get there, CFOs should include AP teams in broader discussions around finance goals and strategy. This will ensure not only that their knowledge is utilized, but also that the AP team collaborates with key stakeholders and takes a forward-thinking approach to their work.

Get the right people in the right seats

46% of businesses report an increasing skills gap, so AP teams must work hard to ensure they have the right talents on the team. This task can be simplified with collaboration and training.

In cooperation with the CFO, AP leaders should build a long-term vision for the team, answering questions like:

- What skills are needed now? What skills will be needed in the future?

- Can we train current staff? What positions do we need to hire?

- What positions will become automated? Where will new positions be needed?

Strategizing in such a way will ensure you have an AP staff ready to excel—now and in the future.

Account payable technology: the key to a smart, efficient, game-changing AP team

By investing more in accounts payable function, organizations can become more efficient and profitable. They’ll ensure business continuity, even during an unpredictable pandemic. They’ll also build resiliency and unlock new opportunities and growth.

Of course, no AP function evolves without a built-in foundation of seamless, holistic processes. The only way to achieve this is by adopting best-in-class solutions. You need a unified platform that enables automation and utilizes advanced invoice-to-pay technology.

Some AP teams flock to well-known solutions like SAP Concur. Built on ‘90s legacy technology, SAP Concur doesn’t have the dynamic features your AP team needs:

- SAP Concur relies too much on manual work for creating and submitting claims.

- SAP Concur lacks true real-time reporting and analytics.

- The SAP Concur mobile app doesn’t have full, robust features.

Instead of SAP Concur, opt for Emburse Chrome River—a smart spend management system built on new technology that drives greater efficiency. Chrome River gives you an all-on-platform that empowers your AP team to achieve best-in-class performance.

See all the features Chrome River has? No wonder 88% of businesses that switched from SAP Concur to Emburse Chrome River saw positive ROI within one year.

With automated invoicing and payments, complete integration, and real-time metrics, Chrome River gives your AP department the tools to help your company become more efficient, smart, resilient, and profitable. It’s the tool you need to maximize the potential of yourAP function (which is crucial during a pandemic).

If you want to have an efficient, intelligent AP team, get Chrome River—the most efficient, intelligent AP software. Click the link below to get started.

Change the Game with Chrome River ➔

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.