Maximize revenue. Minimize spending. That’s the key to financial success, right?

While following that path is easier said than done, there is a quicker way to reduce your expenses right now: negotiate discounts with your vendors.

For example, before the pandemic, major airlines like American Airlines and Delta Airlines offered corporate discounts, benefits, and services to large businesses. By showing them how often your employees paid for their services, you could negotiate meaningful discounts.

Over the past year, as we’ve seen a shift from in-person work and frequent business travel to more remote work and remote meetings. Working from home has become the new normal—at least for now. But with many industry experts predicting that business travel will be at pre-COVID levels again by 2025, it’s the perfect time to negotiate with your travel partners.

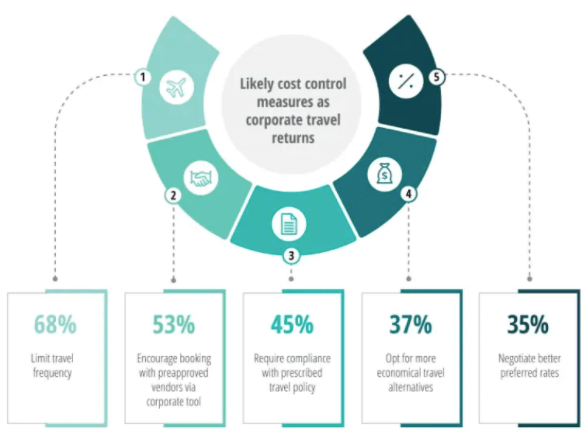

According to Deloitte, travel managers are investing their time and resources into a number of cost control measures as travel slowly resumes. Over a third (35%) of travel managers are negotiating preferred rates with their travel partners.

So whether you’re a CFO at a medium-sized company or an AP manager at a Fortune 500 company, there’s no better time to negotiate better rates and terms with your travel partners. You’ll find that most (if not all) of your travel vendors are also willing to hear you out—after all, they’re desperate to keep their existing clients.

Whatever the case may be with your current travel partners, the essence of vendor negotiation remains the same: show them your spend data and put the ball in their court.

The problem is that if you don’t track your spending, you’ll likely miss out on discounts. Without accurate spend data, you’ll have no leverage in your vendor negotiations.

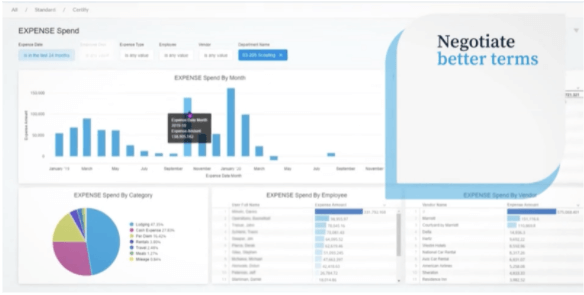

To maximize savings on major expenses and business expenditures, you need spending visibility and clear data—but you also need to leverage data analytics and have access to actionable insights to get the best deals and build stronger relationships.

Ensure correct, clean, unified data before supplier contract talks

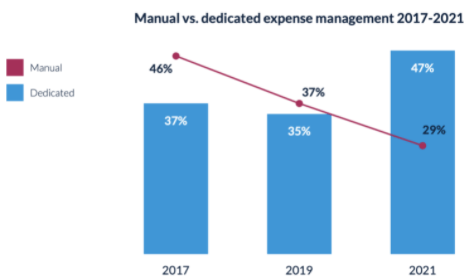

More organizations are employing dedicated expense solutions than ever before1. However, the majority still manage expenses manually.

Source: 47% of companies used a dedicated expense management solution in 2021, versus just 37% in 2017

Do you know the saying, ‘garbage in, garbage out’? The first step in using your data to negotiate with vendors is to ensure you have good data (no garbage!).

Manual expense management creates problems and can leave you in a disadvantageous position when negotiating deals with vendors. In fact, plenty of research shows that a whopping 88% of spreadsheets contain mistakes2.

Of course, while having a modern, cloud-based expense management solution can greatly improve the quality of the spend data your company collects, it’s not enough on its own. Properly analyzing all that data to reach actionable insights that can lead to faster consensus and better decision-making should be the ultimate goal of any modern finance team.

More importantly, without that level of data clarity and analytics confidence, you can’t possibly negotiate the best deals with suppliers, vendors, contractors, and other third parties.

Source: Collecting better data and deploying better analytics solutions helps organizations optimize spend management.

The latest cloud-based expense software can also ensure that you remain in compliance and within budget, as automated workflows and processes prevent out-of-policy spend and make certain that all expenditures are recorded in real-time. This guarantees that you have accurate, comprehensive datasets.

Because hard numbers are persuasive, data is your best tool to negotiate better discounts with vendors. With a system that helps you gather correct data into a clear, intuitive format, you’ll be in a much more advantageous position to convince vendors that your company deserves better terms.

Extract actionable insights to guide negotiations with vendors

While most organizations do have expense data on hand, the vast majority don’t use it to discuss contracts. According to an Emburse survey, only 5% of organizations use expense data for negotiations with vendors 3.

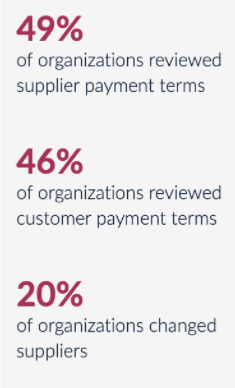

But many companies do review supplier payments, which means vendor terms are important to firms. The latest Emburse research shows that 49% of organizations reviewed supplier payment terms in 2021, with 20% actually changing suppliers based on their existing terms.

Source: Since supplier payments are such a concern, why don’t companies use data to get discounts from suppliers? The answer: they don’t have the tools to do so. This is where data analytics enters the picture.

Just collecting the data isn’t enough, however. Once you’ve obtained correct, clean, unified data, you must transform it into actionable insights. Your data analysis can highlight spending patterns and deliver a variety of insights, covering topics such as:

- The most common business expenditures for work-from-home employees

- Where you overpaid, saved, or went over/under budget

- Non-compliant or potentially fraudulent transactions, if any

- Most frequently visited business destinations

- Most frequently used airlines, hotels, and rental car companies

Armed with such insights, your team can confidently build a stronger strategy for the negotiating table, increasing your likelihood of getting a discount.

For instance, whenever business travel picks up again (hopefully in the near future), you’ll be prepared to negotiate bulk discounts on hotels, flights, rental cars, dining, and more. For example, if your Sales team plans on frequently flying to a certain city, you can use past and real-time spend data to discuss a discount rate with the airline on that specific flight route.

Or, if you notice that most of your remote employees are buying specific office supplies on Amazon in bulk, maybe it makes sense to negotiate directly with the wholesaler or supplier (e.g., Staples, Office Max, etc.).

These types of ad-hoc negotiations work because you’re armed with accurate, up-to-date spend data. Many vendors will be willing to give you preferred rates if it ensures high transaction volumes. After all, they don’t want your business taken away by a competitor.

Be transparent with vendors about expense management policies

Using data for negotiations with vendors involves first organizing the data, and then extracting actionable insights for negotiations. It also involves good-old negotiation skills, such as persuasion, cooperation, and communication. You obviously can’t just yell, “Hey! We’ll take our $100,000 worth of business elsewhere!” There has to be give and take, and you must give the vendor motivation to give you a discount.

That’s why, when it comes to using data for negotiations with vendors, you should show them just how well you manage employee spend. Vendors won’t as readily agree to lower prices if they don’t know your travel and expense behaviors, spending management process, or approach to policy enforcement. They will also be less willing to lower prices if they get the sense you don’t have full control of spend.

Unfortunately, vendors are right to be hesitant about price discounts. After all, many companies could improve their T&E policies and budgeting. Emburse research discovered that 27% of companies report that less than three-quarters of all submitted expense reports are compliant 4.

No wonder vendors can be hesitant to give discounts. They may worry the data on your end isn’t accurate.

Considering this, the best way to put such worries to rest is with data transparency. An expense management platform with powerful data capabilities offers unmatched visibility for vendors, showing everything from your budgeting efficiency to category spending patterns. Be transparent with your vendor, discussing your spend management policies and processes, as well as the solutions you use to ensure reporting accuracy.

Source: Show your vendor how you issue virtual and physical cards to track spending. This way, they can easily see when one of your employees spends at their hotel, airline, restaurant, etc.

If vendors see that you use expense tools with powerful data capabilities, they’ll have more trust in your company, and will therefore be more likely to agree to discounts. That’s because they won’t have to worry about inaccuracies, fraud, or non-compliance (which costs them money and resources).

At the end of the day, trust matters most. Data transparency can help establish trust with vendors and let them see that you have full control of your T&E policy, ultimately pushing them toward giving you the best deal.

Make negotiating with vendors a key part of business strategy

Every company should leverage data during negotiations with vendors. It’s the best tool to help vendors understand why they should provide discounts.

Remember: the goal is to develop a mutually beneficial relationship that drives spending to your supplier while saving your company money. Make data a core part of contract talks, and you and your vendor will reach win-win agreements much more effectively.

Of course, you can’t use data for negotiations with vendors if you don’t have the right tools. With Emburse Analytics Pro, our powerful data solution, you can perform advanced data manipulations and gain the insights needed to negotiate better vendor terms.

At Emburse, we have a suite of robust expense management solutions at the ready. Let us help you leverage data so you can obtain better deals with vendors, build great relationships, and take your business to a more profitable future.

Use Your Data to Get Discounts Today

1 https://www.emburse.com/assets/pdfs/21.emb.dem_trendsreport_infographic.pdf

2 https://www.winspc.com/trending-88-of-excel-files-contain-errors/

3 https://www.emburse.com/assets/pdfs/21.emb.dem_trendsreport_infographic.pdf

4 https://www.emburse.com/assets/pdfs/21.emb.dem_trendsreport_report-fa.pdf

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.