Have you seen this video of a moose on the loose blocking traffic on a highway? While entertaining, drivers on the road were undoubtedly frustrated by the resulting 50-car pileup.

The lesson here is simple: your accounts payable function can’t have bottlenecks. And those bottlenecks will slow down processes and waste company time, money, and opportunities.

While the COVID-19 pandemic has accelerated digitization, too many companies have a ‘loose moose’ on the road when it comes to accounts payable work. Traffic isn’t flowing as efficiently as it should.

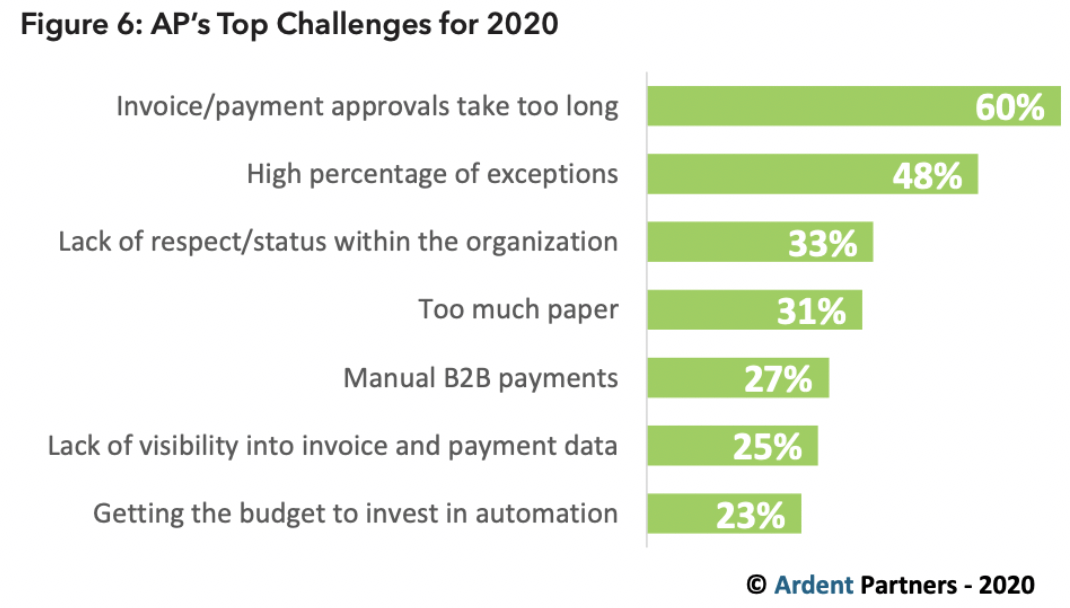

Most notably, there remains a persistent paper problem: 49% of invoices still require manual processing (Ardent Partners). 60% of AP teams state that making invoice and payment approvals more efficient is a top priority. However, only 15% of AP departments have fully automated reporting and analytics capabilities.

As you can see, most AP teams and systems have room for growth. Firms that invest in both their people and their technology position themselves well to unlock the full potential of the AP department. And they’ll reap some attractive rewards—not only because their AP team will be more efficient, but also because they’ll position their AP function to identify and capitalize on opportunities.

Make the AP team a core part of the business

To be the best-in-class accounts payable team, businesses must value their AP departments. Unfortunately, however, that’s not always the case.

According to a report from Ardent Partners, one-third of AP teams cited a “lack of respect/status in the organization” as the top challenge to overcome.1

When AP departments aren’t seen as crucial to a business, they won’t have the resources and tools needed to maximize savings and efficiency. That, in turn, means businesses miss out on leveraging accounts payable to improve profits and financial health.

The solution here is for accounts payable leadership teams to communicate the value of investing in their department. And it’s data that can help to convince decision-makers and execs. After all, the numbers say it all.

- Invest in automation: AP automation can save companies $16 per invoice. If your business manually processes 200 invoices per month, you’d save $38,400 per year with automation.

- Invest in talent: AP team members should have the right mix of soft and hard skills—especially data analytics skills, negotiation skills, supplier management capabilities, a customer service mentality, and attention to detail and accuracy. Such skill sets can make the department much more effective and efficient. Additionally, you should invest in employee well-being, as happy workers are 12% more productive.

- Invest in an accounts payable platform: 46% of companies achieve an ROI in less than one year after switching to a cloud-based expense system, according to an Emburse study.

By showing them the hard data, the C-suite will clearly see the value of having a best-in-class AP function, giving them the motivation they need to invest in the team. And you’ll have the time and resources needed to hire the right talent and adopt the best technologies.

Simply put, your AP team must be seen as a driver of performance and growth—not just a department that processes payments. For that to happen, you must work on improving collaboration with key stakeholders. Once they see the untapped potential of the department, these stakeholders will invest in accounts payable functions and elevate the department’s standing in the company.

Eliminate inefficiencies in your AP function and push for change

The financial supply chain has a wealth of untapped value. Unlocking that value begins with getting management to commit to investing in the AP and finance departments. The continued success of your AP function, however, hinges on eliminating inefficiencies within your team.

Here’s the good news: with some work, you can become more efficient. After all, the most efficient accounts payable teams weren’t built in a day. You can get there by performing an

honest analysis of where improvements are needed and then taking action to correct what’s wrong.

What’s your current performance?

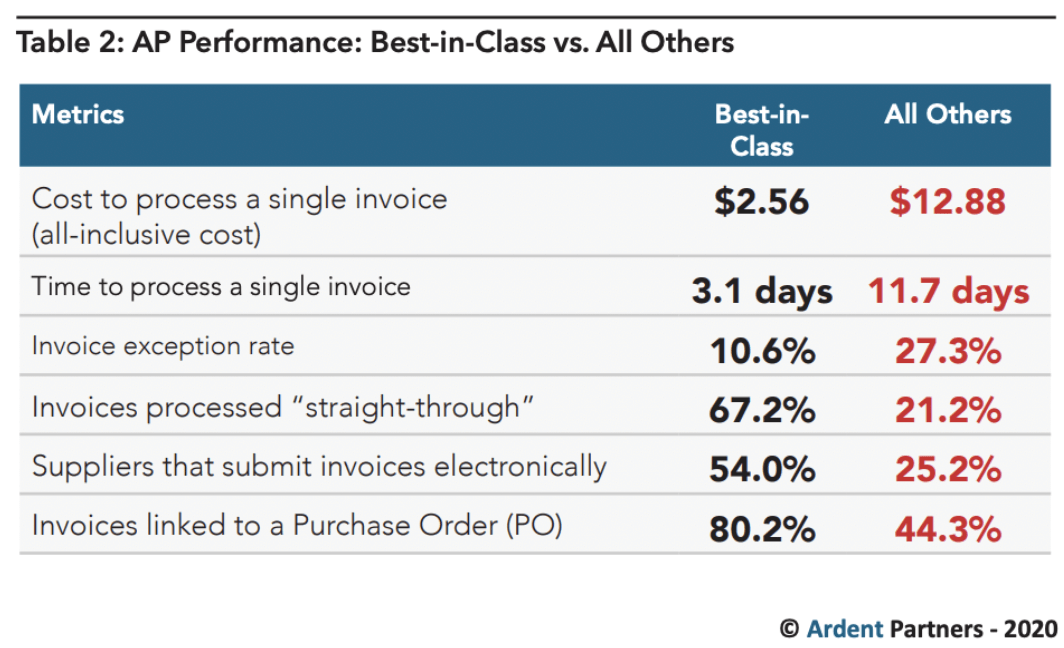

First, you need to determine how you stack up against the best-in-class accounts payable teams. A study from Emburse Chrome River and Ardent Partners can offer some perspective on where you stand.

Best-in-class AP teams are hyper-efficient at all aspects of invoice processing. For example, best-in-class teams have a 3.2x higher “straight-through” processing rate. (source)

You can’t improve what you can’t track. First, figure out how you’re performing. Then, push for change with a clear-cut strategy to improve your AP function.

What accounts payable tasks can you automate?

The savings you can achieve with automation are incredible. For instance, accounts payable staff who automate invoice capture and payments save one full hour each day. Automation should be top of mind for every accounts payable team.

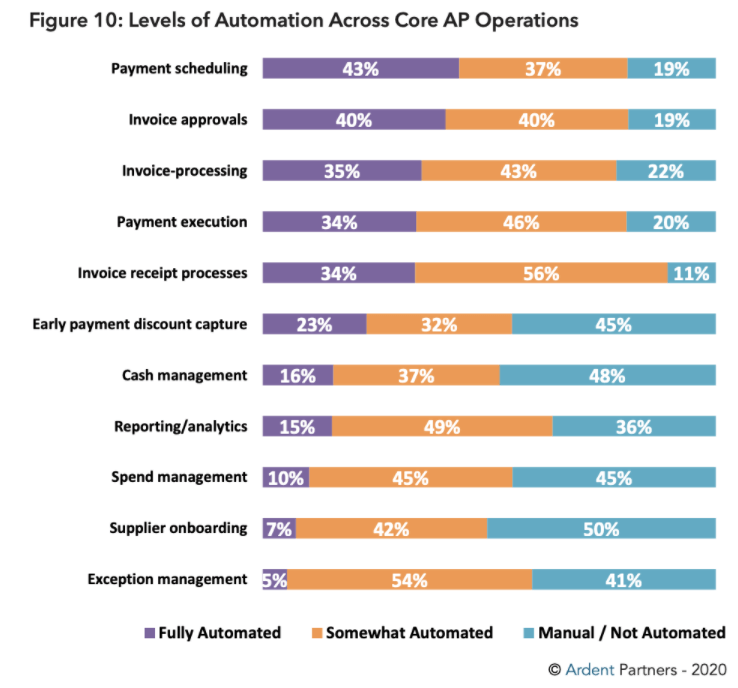

Increasingly more core AP operations are fully automated (or at least partially automated). However, far too many tasks are still being done manually, such as payment execution (20% of companies), cash management (48%), and early payment discount capture (45%).

Automation and greater technological capabilities will help streamline processes and empower AP teams to unlock more value for businesses. (source)

What important competencies does my team need?

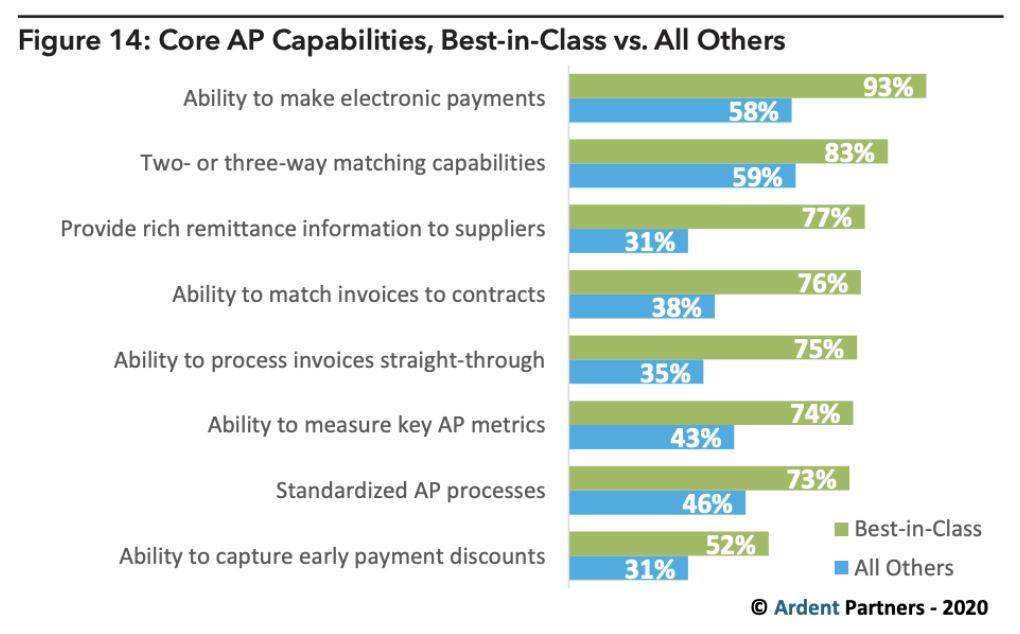

The top-performing accounts payable teams have the following core capabilities (compared to the rest).

Compared to average-performing AP teams, the best-in-class AP teams leverage e-payments, provide rich remittance information to suppliers, and capture early payment discounts at a much higher rate. (source)

Take inventory of what your team can and can’t do, and then make a plan to fill those gaps. Most likely, you’ll need to update or adopt new technologies, plus train or hire for certain skills.

Equip your AP team with best-in-class technology

Industry research shows best-in-class AP teams are:

- 2.1x more likely to use electronic invoicing

- 2x more likely to use automatic matching of invoices to contracts

- 2x more likely to have full procure-to-pay automation

Best-in-class AP teams are also 2.2x more likely to view data and intelligence as critical to the organization. That’s why they’re busy converting data into value by performing cash flow analysis, forecasting, and budgeting. They even use data to ensure compliance and stop fraud.

So, the evidence is clear: best-in-class AP teams leverage technology to automate processes and deliver greater value.

The best-in-class accounts payable solution you need

You’re only as good as the tools you use. Because of this, it pays to do your due diligence on what the right AP solutions should offer.

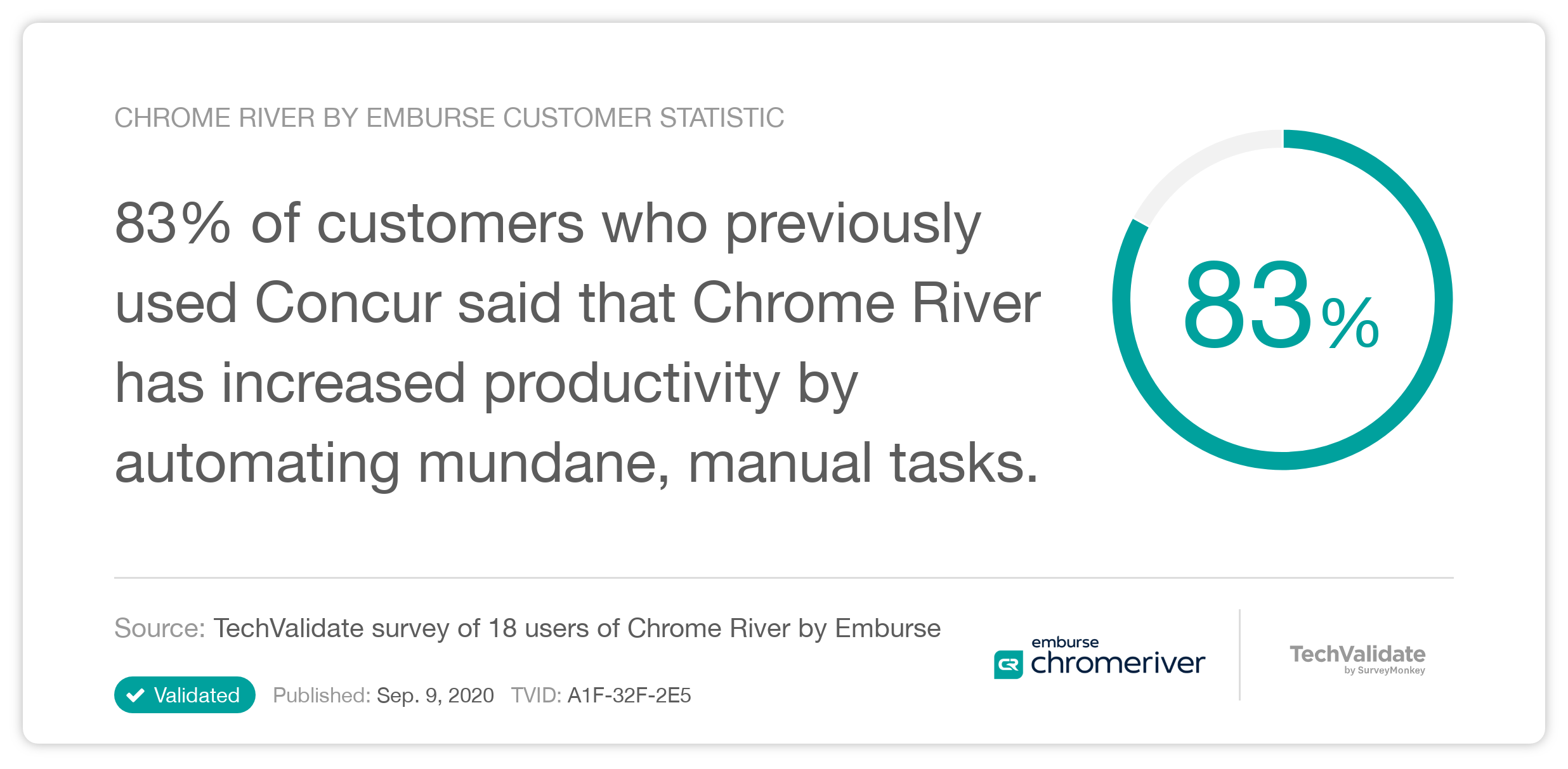

You may, for instance, think that SAP Concur—given its name and status in the expense management and accounts payable industry—is worth the investment. However, SAP Concur came out in the 1990s. Sure, Concur has been updated since then, but only piecemeal. It’s still built on legacy technology, and it lacks many of the features you need to become a best-in-class AP team.

What you need is a smarter system that drives greater efficiency. Your software should tear down obstacles (i.e., get the ‘loose moose’ off the road). This way, you can focus on adding value.

One AP technology solution to consider is Emburse Chrome River—a cloud-based AP solution built for the 21st-century enterprise. With totally mobile expense reporting and invoice processing, Chrome River offers you an all-in-one platform for mastering spend management.

Built for today’s top AP teams, Chrome River is a best-in-class AP platform that’s designed to grow with you. This robust software will enable you to improve reporting and analytics, eliminate paper-based and manual tasks, build better relationships with suppliers, and boost worker happiness. With such capabilities, you can unlock the full value of your organization’s AP function.

Only the best for best-in-class AP teams

Don’t get stuck using manual processes and outdated technology. Your AP team deserves better—because the better your AP team performs, the better off your organization will be.

Agile, cloud-based accounts payable solutions like Emburse Chrome River automate and streamline AP processes while leveraging the full potential of expense data analytics. Built with future-ready mobile technology, Chrome River gives your AP team a seamlessly integrated, fully supported suite of customizable tools.

If you want to be a best-in-class AP team, get Chrome River—the best-in-class AP software.

Do More With Your AP Team in 2022

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.